Art insurance: protecting collections and their value

A work of art deteriorates, is stolen or broken… and its value vanishes.

Standard insurance does not always treat art as a separate asset.

Many SMEs and managers in French-speaking Switzerland own works of art: in offices, in storage, on loan, or in exhibition.

The risk is not only theft. It includes breakage, fire, water, transport, handling, and gradual degradation due to climate or inadequate storage.

However, traditional "property" insurance policies may be insufficient or too restrictive for valuable items, particularly regarding valuation, security conditions, and limits per item.

Art insurance is designed to address the specific needs of these items: value, restoration, transport and formalities, according to the contract.

Art insurance: agreed value, conditions and claims handling

The challenge is to protect the value and traceability, not just the object.

Art insurance aims to cover works and valuable objects that do not behave like “standard” goods.

A work of art can have a unique value, variable liquidity, and a particular sensitivity to its environment. Specialized insurance policies therefore often take into account appraisal, conservation, transport, and the management of any restoration.

For an SME, this concerns as much a collection displayed in offices as works in storage, pieces loaned to events, or art objects used in an image strategy.

What art insurance typically covers depends on the contract, but it often includes protection against accidental material damage (breakage, impact, falling), events such as fire and water damage, and theft, subject to security conditions.

Policies can operate on an “agreed value” basis or on defined valuation methods, which directly influences compensation.

Some provide for the handling of restoration, with specialized providers, and can address residual depreciation after restoration, depending on the conditions.

Extensions may cover transport and exhibition, with strict requirements on packaging, handling, carriers and venues.

The points of vigilance are specific. First, the inventory and the proof: descriptions, photos, dimensions, provenance, invoices or certificates are required, and sometimes expert opinions.

Without traceability, a claim becomes difficult to compensate.

Next, security: alarms, access control, display cases, storage conditions, and sometimes surveillance depending on the value. Policies often set minimum requirements, and failure to comply can limit compensation.

Thirdly, the environment: humidity, temperature, light. Gradual damage caused by poor conditions can be ruled out or treated restrictively.

Fourth, transport: packaging and choice of carrier are critical, and a simple non-compliant "delivery" can be grounds for dispute. Fifth, limits and deductibles: there may be limits per item, per event, and deductibles adjusted to the value.

For an SME, choosing the right level of coverage starts with clarifying the use of the works: permanent exhibition, rotation, loan, events, regular transport.

Next, establish a structured inventory, and define a value policy: periodic updates, expertise for important pieces, documentation of acquisitions.

Then, calibrate the police: perimeter (premises, reserves, possible residences depending on conditions), transport (door to door, exhibitions), and realistic security level.

A useful mini-list includes validating the valuation method (agreed or otherwise), security requirements, transport and handling conditions, restoration and depreciation coverage, and limits per item.

Mage & associés can assist you in a risk analysis and policy review, translating conservation and security requirements into understandable insurance conditions.

The aim is to avoid "too general" coverage which proves insufficient on the day of a breakage or theft, and to have documentation ready, which speeds up the management of a claim without improvisation.

Trois risques majeurs pour les œuvres et objets de valeur

This is where specialist coverage makes a real difference.

Accidental damage and breakage

A fall, a shock, handling, hanging: an incident can irreparably damage a work of art.

According to the contract, art insurance covers breakage and may include restoration and potential depreciation, with strict conditions.

Theft and security of premises

Theft often targets the most visible parts.

Security requirements (alarm, access, storage) are crucial.

A dedicated policy specifies these conditions and may also cover loan or exhibition situations, depending on the contract.

Transport, loan, exhibition

Transportation is a critical moment: packaging, handling, transit, customs.

Specialized insurance can cover these phases, depending on the terms, and clarify who insures what during a loan or exhibition, thus avoiding disputes.

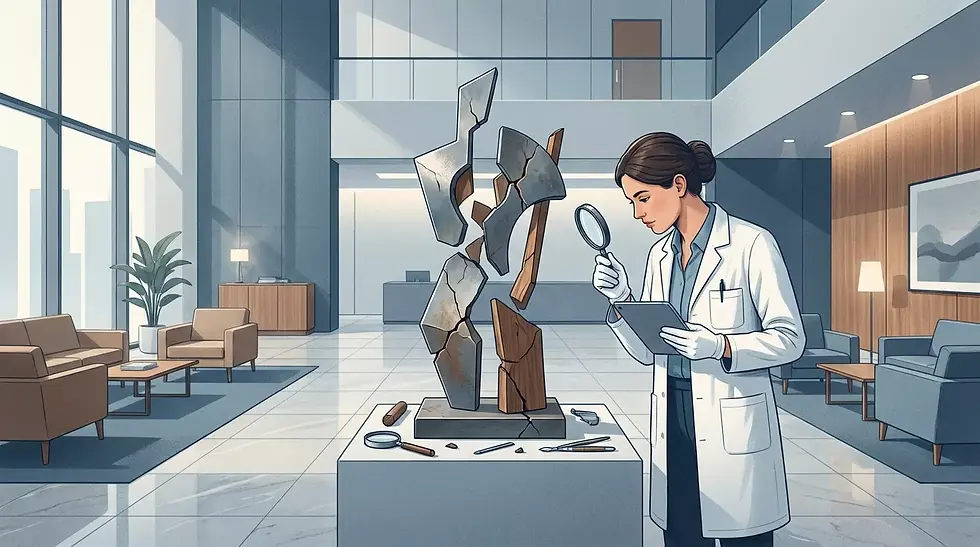

Artwork damaged during a renovation: restoration and value

A realistic fictional example, inspired by offices in French-speaking Switzerland.

Realistic fictional example.

A small consulting firm in Geneva is renovating its offices.

A valuable sculpture, displayed in the reception area, is moved by a non-specialized contractor.

Despite careful handling, the artwork toppled over and suffered a crack. The incident is embarrassing: the object is unique, its value is significant, and management fears lasting depreciation.

The SME has art insurance with documented inventory and value. It reports the claim quickly with photos, description, circumstances, and contact details of those involved.

The determining factor is traceability: documentation of the artwork, proof of value, and compliance with the prescribed safety conditions. The insurer then appoints an expert and a specialized restorer.

The restoration is organized in stages, with validation of techniques and costs.

The resolution is realistic: the work is restored, but a slight depreciation is discussed according to the contractual terms.

In parallel, a liability aspect may concern the service provider, but the SME avoids an immediate conflict thanks to a factual management of the case.

The operational lesson: art must be managed like a sensitive asset. Inventory, handling procedures, and dedicated coverage prevent a logistical incident from becoming a financial and reputational crisis.